WSO Alpha Historical Performance

In this issue of the Peel:

Market Snapshot

Happy Wednesday, apes.

Back to your regularly scheduled programming, and to compensate for yesterday’s wild edition of the Peel, we got an extra-long one for you apes today.

Some of the very wisest apes out there have already hopped on the Alpha train, and after you see what we’ve been cooking for more than the last decade down below, hopefully, the rest of you will hop on board as well.

Let’s get into it.

Start the Monkey Business Now – CapLinked’s Sending You to Thailand

Ever get the feeling you & all your presentations are stuck in the past? Worry not!

auxi - The spooktacular AI add-in for PowerPoint.

Or go to www.auxi.ai/demos to learn more

Banana Bits

Macro Monkey Says

The Most Wonderful Time of the Year

Hope you’re stocked up on Zyn and coffee this week, apes, as earnings szn is BACK and, given the insanity of 2024 so far, we have a feeling we won’t be leaving our desks for a while.

Sure, all earnings szns are great (some might even say the real most wonderful times of the year), but none are better than Q4.

And that’s because most companies give us their full-year results, too, and because of that, they take a bit more time to compile.

That means their reports are much more spread out than other earnings szns, giving us more time to digest the numbers.

Apparently, however, America’s largest banks didn’t get the message because the 6 most valuable of them have all released earnings in the last two trading days alone. We got a lot to cover, so let’s get right into it.

J.P. Morgan: Mr. John Pierpont Morgan likely would’ve been proud of the quarter his company had, despite the fact that Wall Street wasn’t particularly pleased with the biggest, baddest bank in the land’s numbers.

The world’s most valuable bank missed expectations on earnings but squeaked out a beat on top-line revenue, reporting:

Record revenue was primarily driven by exposure to consumer banking amid the rate hikes of the last few years, driving net interest income 19% higher than in 2022.

EPS would’ve been $3.97/sh, excluding $743mn in losses on the firm’s investment portfolio, along with a $2.9bn loss linked to saving America’s regional banking system by absorbing First Republic.

Going into 2024, concerns center on exposure to CRE loans, primarily those linked to office buildings, and expanding consumer credit balances.

Bank of America: The big bank that dipped out of New York before it was cool, moving its HQ to Charlotte, NC, in 1998, reported a decent quarter of its own.

Going the opposite route of the big dawg up top, BofA managed to beat on the bottom line, but revenue came up just short of estimates, with the firm posting:

Despite the beat, GAAP EPS of $0.35/sh came in ~50% lower than the year prior. That was primarily due to a $1.6bn charge related to shifting away from the old LIBOR-based rate systems to the cool, new, and way sexier SOFR system.

Plus, BofA had to fork over a $2.1bn fee to the FDIC, largely thanks to SVB and Signature Bank collapsing, along with taking $1.1bn in credit loss provisions.

Net interest income actually decreased at BofA, thanks to their need to pay higher rates on lower deposit balances, presumably so customers didn’t bail for the larger, “safer” J.P. Morgan.

This is the first time in 2-years that Bank of America missed revenue estimates, largely due to a 4% drop in consumer banking revenue, with only a 3% jump in that of the sales & trading division to make up for it.

Wells Fargo: Congrats to Wells Fargo for being the first of the banks covered today to beat on both earnings and sales, as seen here with the third largest consumer bank in America reporting:

Again, the FDIC got their grubby little fingers on this bank as well, charging $1.9bn related to the savior of SVB and Signature once again. Thankfully, the firm was granted a $ 621mn tax benefit to offset the $ 969 in severance costs charged as well.

Lower deposits and loan origination volume led to net interest income falling 5% for the quarter, with management warning that NII for the full year could fall as much as 7-9%.

Provisions for credit losses grew a huge 34% at the same time, ballooning to $1.28bn from the $957mn stocked up at the same time last year.

Morgan Stanley: Despite solid earnings on Tuesday, the loss of Wall Street heartthrob CEO James Gorman is already taking a toll on shares.

New CEO Ted Pick warned investors of economic challenges to come, which, along with the one-time charges the bank paid last quarter, pulled shares into a rocky day. For the fourth quarter, MS reported:

But, due to those charges, it’s likely not a very fair comparison on the bottom line. In addition to the same FDIC payments as those above, Morgan Stanley threw $ 249mn at the SEC to settle a criminal investigation. Classy stuff, guys.

Otherwise, MS had a solid quarter driven by investment banking revenue rising 11.7% thanks to increased underwriting on investment-grade bonds.

Goldman Sachs: As the only Wall Street firm that actually seemed to investors happy in their immediate response to quarterly numbers, Goldman shares were looking, well, gold on Tuesday.

The firm beat on both the top and bottom line, but that bottom-like figure seen below probably isn’t comparable to the $3.51/sh expected due to changes in expense reporting compared to last year. Nevertheless, in Q4, GS delivered:

That’s a 51% jump in net income, stemming from a strong 7% rise in total revenue thanks to accelerated growth in the firm’s wealth and asset management division.

CEO David “DJ D-Sol” Solomon is still around despite his budding DJ career nearly throwing him in the gutter, but it’s hard to be mad at 23% growth in asset and wealth management, even despite a rockier performance in their fixed income and platform solutions divisions.

Citigroup: Alright, we gotta finish this up before we run out of room for text, but CEO Jane Fraser and Citigroup had easily the most… let’s call it “interesting” report of all.

$4.6bn in charges related to the firm’s ongoing restructuring took nearly $2/sh off the bottom line, making the below numbers not exactly comparable, but the firm still missed on revenue, reporting:

领英推荐

Revenue fell 3% annually, but according to the firm, excluding charges related to divestitures in Argentina would show 2% annual revenue growth. Still not enough to outpace inflation, however.

The goal of the restructuring here is to simplify and—to use every MBA’s favorite buzzword—“streamline” the firm’s business.

What's Ripe

Carrols Restaurant Group (TAST) $9.47 (↑ 12.47% ↑)

Advanced Micro Devices (AMD) $158.74 (↑ 8.31% ↑)

What's Rotten

Spirit Airlines (SAVE) $7.92 (↓ 47.09% ↓)

Boeing (BA) $200.52 (↓ 7.89% ↓)

Thought Banana

WSO Alpha Exposé—Total Annual Returns

Alright, apes, now that a bunch of you are getting on board the WSO Alpha train, we figured it was time to give you a bit of a breakdown and see exactly what the hell is going on here.

Once again, our legal experts are up my *ss on not “violating securities law” and “making fraudulent statements” like a bunch of nerds, so we’ll, unfortunately, have to keep our cool here as much as we can.

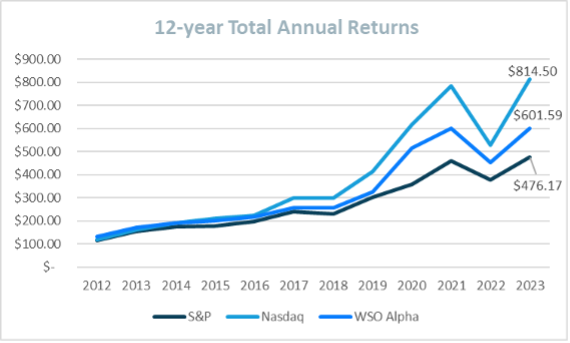

Simply put, WSO Alpha is our real-money, long-equity portfolio benchmarked against a combination of the Nasdaq and the S&P. The portfolio was opened in December 2011, and since then, annual returns have looked a little something like this:

As you can see, over the past 12 years, we’ve achieved a higher average return than the S&P but have fallen short of the Nasdaq.

And that’s largely attributable to the “barbell” strategy that our portfolio employs. We love speculation as much as SBF loves scamming people, so we try to achieve a balance between hella risk-on, growth names paired with positions in safer assets.

These range from exposure to both BTC and ETH to cash positions in the money market and income funds like $JEPI (what a GOAT that thing is).

So, comparing a $100 investment in our portfolio vs that of our benchmarks from January 1st, 2012 through to today, we get something like this:

During years in which riskier assets dominate returns, like in 2020, the portfolio takes that for a ride and then some.

But, during years like 2022, where riskier assets suffer more than my brain during a calculus exam, the barbell strategy keeps us mildly safer than our riskier benchmark friend but still gets down bad compared to others.

Essentially, we seek to employ the degenerate’s version of the 60/40 portfolio. Bonds are way too boring, though, so to us, holdings like Costco and Dollar General take on that role.

Needless to say—this kind of portfolio and investment strategy isn’t for everyone. But, even if you’re not following our trades to the decimal, we still want to hear from you about how wrong our equity research reports and other hot takes are.

In case you missed yesterday’s edition, a WSO Alpha membership gives you:

…and it only costs a couple of bananas each month.

In addition to equity research reports, we will soon be accompanying those with more thematic pieces on the more random but equally speculative themes driving macro and markets.

We’ll be updating you apes here more and more with more specific performances, showing how we employ this barbell-style strategy, but to really understand, you gotta check things out on the WSO Alpha page right here.

Who knows, with enough interest, maybe we can launch a damn ETF or something someday, and if that day comes, all you apes that join us on the ground level will have a serious claim to fame and bragging rights to go along with it.

Feel free to shoot us any questions, comments, and the usual hate messages anytime you want. Otherwise, we hope to see you researching and (hopefully) generating some alpha right alongside us.

The Big Question: Our next research piece is on Tesla. What will our research instruct us on what our rating should be? Are you getting in on the action with us? What percent of your portfolio would you throw in a WSO Alpha ETF if we ever do launch it?

Banana Brain Teaser

Monday —

Five machines at a certain factory operate at the same constant rate. If four of these machines, operating simultaneously, take 30 hours to fill a certain production order, how many fewer hours does it take all five machines, operating simultaneously, to fill the same production order?

Answer

6 hours

Today —

The annual interest rate earned by an investment increased by 10 percent from last year to this year. If the annual interest rate earned by the investment this year was 11 percent, what was the annual interest rate last year?

Shoot us your guesses at [email protected].

Wise Investor Says

“There’s a big difference between probability and outcome. Probable things fail to happen—and improbable things happen—all the time.” That’s one of the most important things you can know about investment risk.” — Howard Marks

How would you rate today’s Peel?

Happy Investing,

Patrick & The Daily Peel Team

Absolutely love the insight, especially on the strategic plays by JPM and Citi! ?? As Warren Buffett wisely noted - The stock market is a device for transferring money from the impatient to the patient. Your analysis helps many stay patient and informed! ?? Keep it up, ManyMangoes team! ????

Absolutely insightful update! As Warren Buffett once said, “It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” The resilience and strategies of companies like JPM and AMD highlight the importance of identifying quality in tumultuous times. ??? Speaking of investments, Treegens is sponsoring a unique opportunity for the Guinness World Record of Tree Planting, potentially a great portfolio addition for those interested in sustainable ventures. Details here: https://bit.ly/TreeGuinnessWorldRecord ????