Transforming Banking Through Intelligent Automation

In today’s fast-paced digital era, banks face the dual challenge of optimizing operational efficiency while delivering exceptional customer experiences. At Cyborg Automation, we offer innovative, AI-driven automation solutions that enable the banking sector to achieve these objectives while maintaining a competitive edge and future-proofing operations.

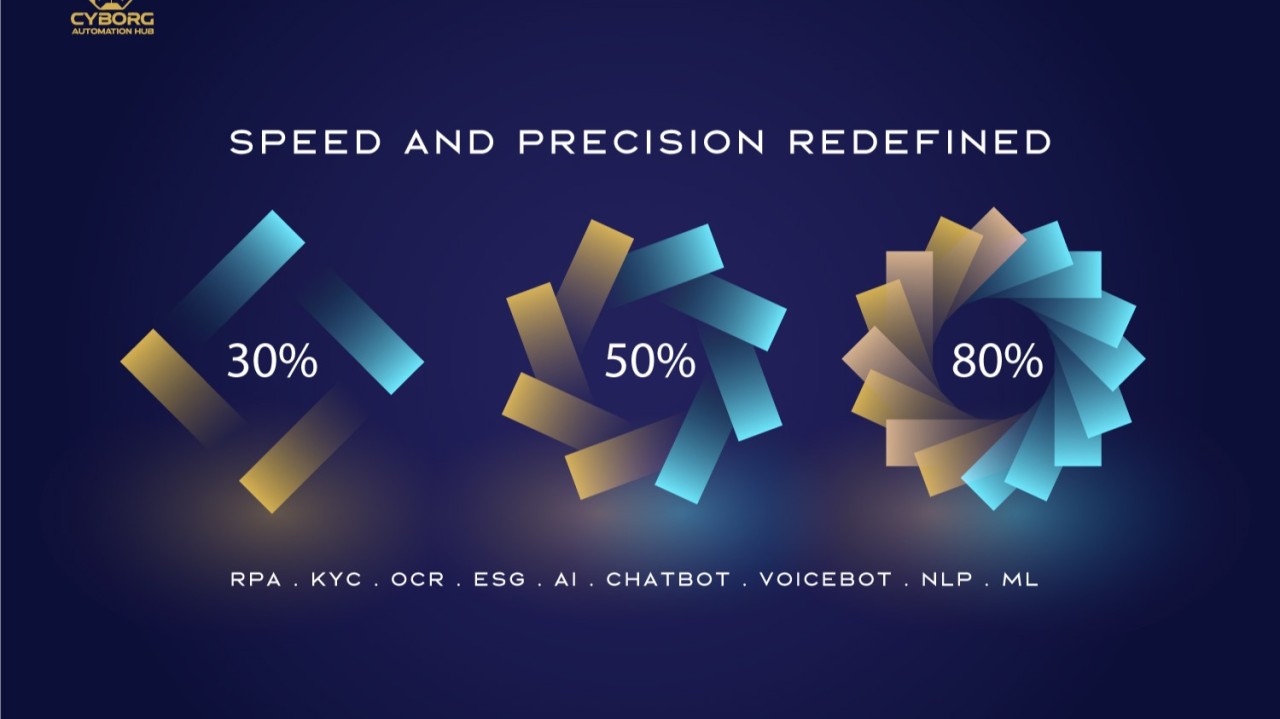

Enhancing Operational Efficiency: Speed and Precision Redefined

Banks handle massive amounts of transactions and data daily, making operational efficiency critical. Automation is no longer a luxury; it’s a necessity to streamline processes and improve accuracy.

Automated Loan Processing: Our solutions reduce loan processing times from days to minutes while ensuring compliance and accuracy.

Financial Reporting: Generate monthly and annual reports automatically with precision, freeing up valuable employee time for strategic initiatives.

Case Study:

A leading bank in the Middle East implemented our automation solutions to optimize internal data review processes. This resulted in a 70% reduction in processing time, significantly enhancing overall operational efficiency.

Revolutionizing Customer Experience with AI

Modern banking customers demand personalized, seamless, and efficient service. Our AI-powered automation tools empower banks to meet and exceed these expectations.

Smart Chatbots: Provide instant responses to customer queries, resolving issues efficiently and reducing wait times.

Personalized Recommendations: Leverage deep analytics to offer tailored financial products and services based on individual customer needs.

Success Story:

A top-tier regional bank adopted our AI-driven customer service platform, leading to a 45% increase in customer satisfaction and a 30% reduction in support center calls, achieving significant cost savings.

领英推荐

Reducing Costs While Maintaining Quality

In the pursuit of innovation, cost control remains a priority for banks. Our automation solutions offer the perfect balance between innovation and cost efficiency:

Lower Operational Costs: Automating repetitive manual tasks reduces the need for extensive human intervention.

Minimized Errors: Automation eliminates costly human errors, enhancing data accuracy.

Streamlined Compliance: Expedite compliance processes with automated reporting and adherence to regulatory standards.

Real-World Impact:

A prominent banking institution successfully reduced its operational costs by 20% in the first year of adopting our solutions, achieving a strong return on investment in record time.

A Partnership for Success and Sustainability

At Cyborg Automation, we believe automation is more than just a tool—it’s a strategic partner in driving business success. Our solutions are tailored to meet the unique needs of each client, and our focus on long-term partnerships is built on innovation, trust, and measurable results.

Lead the Future of Banking

We help banks turn challenges into opportunities by building digital ecosystems that adapt to future demands. With Cyborg Automation, you gain unparalleled efficiency and deliver exceptional customer experiences, setting new benchmarks in banking innovation.

?? Let’s Shape the Future Together—Contact Us Today!

#CyborgAutomation #BankingInnovation #AI #DigitalTransformation #MiddleEastBanking