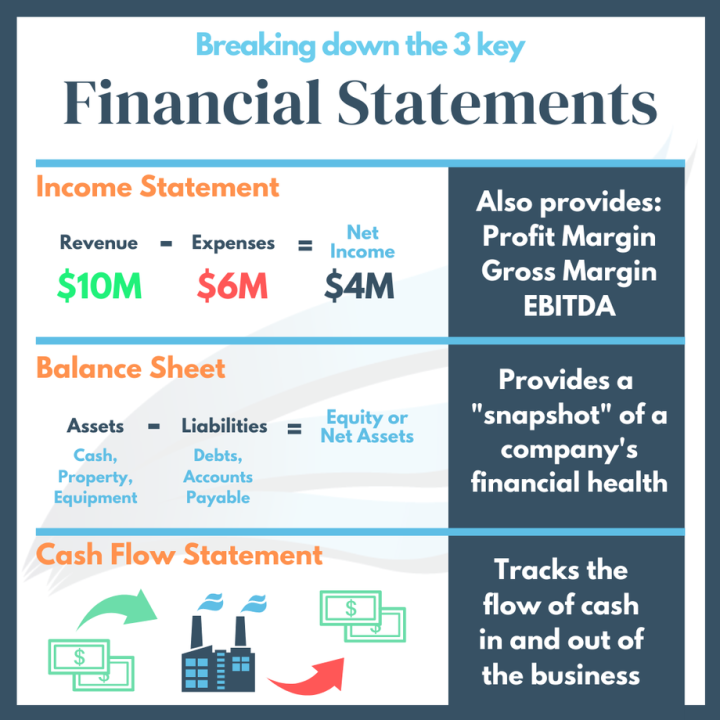

The balance sheet, income statement, and statement of cash flow are three key financial statements that provide different perspectives on a company's financial health and performance. Let's explorer these three statements:

- Purpose: The balance sheet provides a snapshot of a company's financial position at a specific point in time. It shows what a company owns (assets), what it owes (liabilities), and the residual ownership interest (equity).

- Components: It consists of three main sections: assets, liabilities, and equity. Assets are divided into current (short-term) and non-current (long-term) assets, while liabilities are similarly categorized into current and non-current liabilities.

- Timing: The balance sheet is a static statement and does not show financial performance over a period. It reflects the financial condition at the end of a reporting period.

- Equation: The fundamental accounting equation, Assets = Liabilities + Equity, is the foundation of the balance sheet. It demonstrates that the total assets must equal the sum of liabilities and equity, ensuring that the balance sheet remains in balance.

2. Income Statement (Profit and Loss Statement):

- Purpose: The income statement provides a summary of a company's financial performance over a specific period, typically a fiscal quarter or year. It reveals the company's revenues, expenses, and net income or loss.

- Components: It includes revenues (sales, fees, etc.), cost of goods sold (COGS), operating expenses, interest expenses, taxes, and net income (or net loss). The income statement shows how much profit or loss a company generated during the period.

- Timing: The income statement is dynamic and covers a specific time frame, allowing stakeholders to assess the company's performance over that period.

- No Balance Concept: Unlike the balance sheet, the income statement does not adhere to the balance concept. Revenues and expenses are matched to determine net income, but there is no requirement for it to "balance."

3. Statement of Cash Flows:

- Purpose: The statement of cash flows provides insight into a company's cash inflows and outflows during a specific period. It helps stakeholders understand how a company generates and uses cash.

- Components: It is typically divided into three sections: operating activities, investing activities, and financing activities. Operating activities include cash flows from the core operations of the business, while investing activities involve cash flows from investments in assets and securities. Financing activities encompass cash flows related to borrowing, repaying debt, and issuing or repurchasing stock.

- Timing: Similar to the income statement, the statement of cash flows covers a specific time period and helps stakeholders track the movement of cash during that period.

- Reconciliation: The statement of cash flows reconciles the changes in cash and cash equivalents from the beginning to the end of the reporting period, showing how a company's cash position has evolved.

In summary, these financial statements serve distinct purposes. The balance sheet provides a snapshot of a company's financial position, the income statement details its financial performance over a period, and the statement of cash flows reveals how cash has been generated and utilized during that period. Together, these statements offer a comprehensive view of a company's financial health and operations, aiding investors, creditors, and management in making informed decisions.