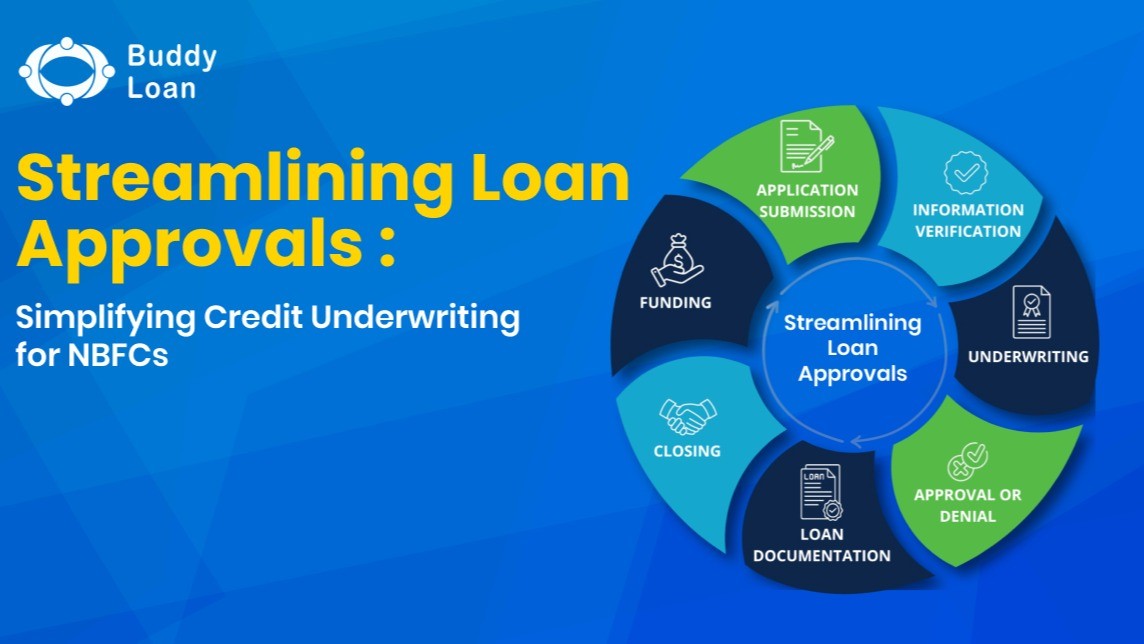

Streamlining Loan Approvals: Simplifying Credit Underwriting for NBFCs

In today’s fast-paced financial landscape, efficiency is key when it comes to loan approvals. Non-Banking Financial Companies (NBFCs) face increasing pressure to streamline their credit underwriting processes to stay competitive and meet customer demands. Buddy Loan is leading the charge with innovative solutions that make the loan approval process faster, simpler, and more accurate.

The Challenge of Traditional Loan Underwriting

Buddy Loans Approach to Efficiency

Buddy Loan’s digital platform and AI-driven algorithms are designed to transform how credit underwriting works for NBFCs, making the process faster and more accurate.

Benefits for NBFCs

Conclusion: Buddy Loan – The Future of Credit Underwriting

Buddy Loan’s platform revolutionizes the loan underwriting process, helping NBFCs make smarter, faster decisions. With real-time insights, automated systems, and AI-backed credit scoring, Buddy Loan streamlines loan approvals and drives efficiency for NBFCs. It’s time for NBFCs to embrace innovation and enhance their lending process with Buddy Loan’s advanced solutions.