Python for Excel: Supercharging Financial Modelling

Microsoft Excel has been the gold standard for financial modelling for decades. However, as financial models grow more complex, integrating Python with Excel offers significant advantages, from automation and scalability to powerful analytics. With the introduction of Python in Excel (natively available in Microsoft 365), financial professionals can harness Python’s capabilities without leaving their spreadsheets.

This blog explores how Python can enhance financial modelling and how modellers can leverage it effectively.

Key Benefits of Using Python in Excel

Automation and Efficiency

Financial models often involve repetitive tasks such as data cleaning, consolidation, and complex calculations. Python’s automation capabilities streamline these processes, reducing errors and saving time.

Advanced Analytics and Machine Learning

Python unlocks access to advanced analytical tools that Excel struggles with:

Seamless Data Integration

Python’s ability to handle large datasets makes it ideal for financial modelling where data is sourced from multiple platforms:

Code Reusability and Collaboration

Unlike Excel formulas or VBA, Python scripts can be version-controlled and shared easily, improving team collaboration.

How to Get Started with Python in Excel

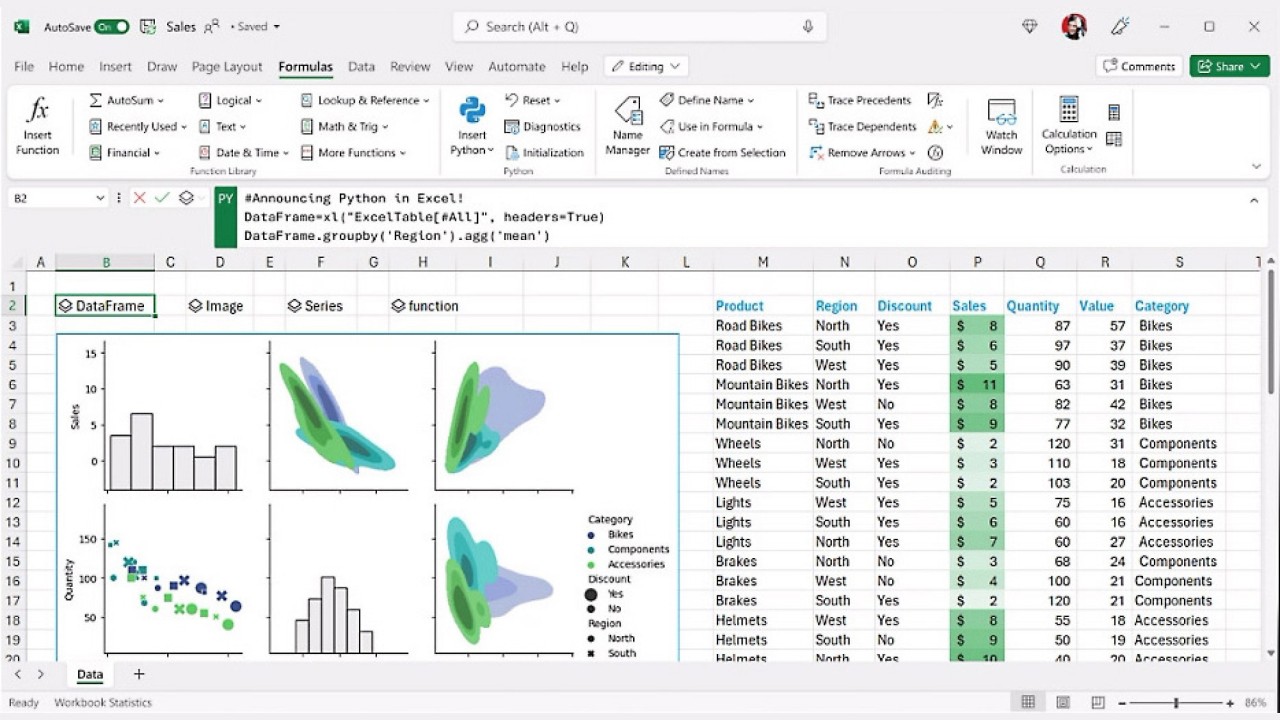

Microsoft has introduced Python in Excel, allowing direct execution of Python code within a workbook. Here’s how to get started:

领英推荐

1. Enable Python in Excel

2. Use pandas for Data Analysis

import pandas as pd

# Read data from an Excel file

file_path = "financial_data.xlsx"

df = pd.read_excel(file_path, sheet_name="Sheet1")

# Perform analysis

df["Return"] = df["Price"].pct_change()

df.describe()

3. Automate Financial Calculations

Calculate Net Present Value (NPV) using Python:

import numpy as np

cash_flows = [-1000, 200, 300, 400, 500]

discount_rate = 0.1

npv = np.npv(discount_rate, cash_flows)

print(f"NPV: {npv}")

4. Run Monte Carlo Simulations

import numpy as np

simulations = 10000

returns = np.random.normal(0.05, 0.15, simulations)

portfolio_value = 100000 * (1 + returns).cumprod()

print(f"Expected portfolio value: {np.mean(portfolio_value)}")

The Future of Financial Modelling with Python and Excel

The integration of Python into Excel is a game-changer. Financial modellers can now combine the intuitiveness of Excel with the power of Python, making models more robust, scalable, and insightful.

Python for Excel allows you to:

? Automate repetitive financial modelling tasks.

? Use Python for data analysis, forecasting, and Monte Carlo simulations.

? Eliminate the limitations of traditional Excel by handling big data and APIs.

? Improve collaboration with code reusability and version control.

Python in Excel is an amazing tool for forward-thinking financial professionals.

Agile Specialist at ShopriteX - Advanced SAFe Practice Consultant (ASPC), A-CSM

3 周Ooh very nice, do you know if the MS GPT will include the python/excel connection?