Mastering the Art of Due Diligence and Valuation Process

Due diligence is a critical process in investment decision making. In today’s market, there has been a lot more scrutiny put into these processes given the higher expectations from investors on potential investments.?

A thorough and effective due diligence process is crucial for investors to make informed investment decisions, build their portfolio, and effectively support their portfolio companies down the line.?

We enumerated 5 key elements investors will have on this process:

Entering every opportunity with a fresh approach

Rethinking first impressions and revisiting assumptions are crucial for a comprehensive understanding of the business and its potential risks.

Pitch Decks (Case for the Startup’s Growth)

A pitch deck provides a concise and clear understanding of the company's proposition, market size, competitive landscape, and growth potential. Pitch decks help investors to visualize the company's growth and understand its key drivers.?

Data Room (Supporting Information)

These provide a comprehensive set of information about the company, including investment decks, past financing rounds, market research, financial records, growth metrics, product roadmaps, and competitive landscape. Data rooms are essential for investors to scrutinize and make informed decisions about the company.

领英推荐

We created publicly accessible guides for data rooms and pitch decks here: https://www.insignia.vc/u/ivafundraisinglib

Thesis / Heuristics on What Makes a Great Company

The "Three Fits" (Founder-Market Fit, Product-Market Fit, and Investor-Founder Fit) and the "T + MC2 + N" framework are mental models that can help investors analyze companies. These frameworks help investors assess the alignment between the founder, market, product, and investor, as well as the team's strength, market size, and potential for growth.

Diverse Perspectives

VC firms ideally have a team with diverse backgrounds and ties to different markets to ensure success in Southeast Asia. This approach allows investors to leverage their expertise and connections to support the company's growth and mitigate risks.?

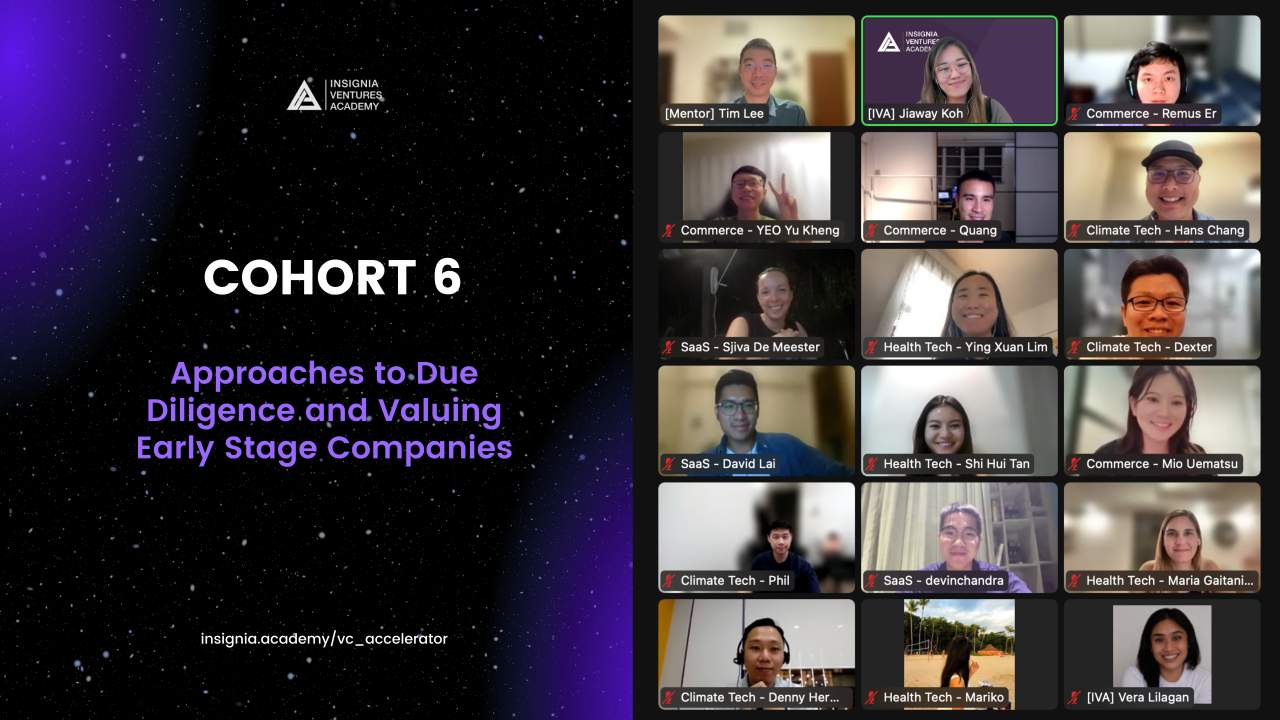

These insights came from chapter 5 of Backing the Bold: A primer in early-stage Venture Capital in South East Asia, as well as our due diligence and valuation session in our IVA VC Accelerator program.?

Delve deeper into the fundraising process from the VC POV in Cohort 7 (March intake) of our Venture Capital Accelerator or Cohort 2 of our StartCFO program. Reach out to program lead Jiaway Koh and seize this opportunity to accelerate your VC career.

Always an important topic. Great to see diverse perspectives valued in this way!

Lanzhou Xiaoxi Technical Services Co. Head of Operations, International Department (Generating Hydroelectricity without Dams Technical promotion)

1 年Our Technology Enables Rapid Global Adoption of Clean Electricity 我们的技术可在全球迅速普及清洁电力 https://www.dhirubhai.net/feed/update/urn:li:activity:7139178605472882688/ We are looking for collaborators worldwide.

Paulo J Jiaway Koh Maria Vera Gabrielle Lilagan