IoT Value chains now and in the future

DIYA SOUBRA

Technology Business Advisor | Market Entry & Growth Strategist | IoT, AI, Semiconductors, Digital Transformation

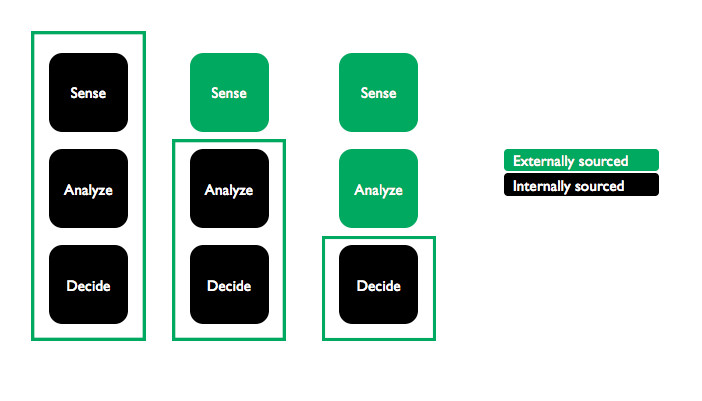

Today, when a company decides to roll out an IoT solution to improve operational efficiency, the management hires a system integrator (SI) to develop and deploy the system. The SI will create and deliver a wholly owned end-to-end solution by externally sourcing all the components required to sense, analyse and decide. There is no room for third parties as active participants in the operation of the system or the data flow. The SI will find the sensors be it in the form of devices or modules. The SI will setup a network topology to collect the data and finally feed that data into the software that will extract information that will be used to drive decisions for that business. After system delivery, the complete IoT rollout is created and managed internally. This is a typical approach for any new technology across all industries. At first, only Fortune 500 companies have the capital to do such deployments and they contract the design and deployment to Tier 1 system integrators since there is no margin for error due to the large investment required.

After a few such companies start to have reasonable sets of data we will start to see the emergence of data cooperation or even data transactions in which there is data exchange between corporations in return for mutual benefit.

Up to this point there are no small players in the picture since there is no room for them. They are too small to be trusted with the task since their technology is not widely deployed yet.

As the technology matures it becomes more economical to no longer own all the parts of the system. (Think of all the in-house servers of the 1990s now happily living in the cloud.) In the case of IoT, the first logical part to be displaced is the sensing part. Imagine the case of a small company placing environmental sensors across a city and giving access to the output data to any buyer. This small company then removes the need for anyone else to develop and deploy such sensors. The value is not in the sensor but in the information extracted from the data acquired from the sensor.

This model maps directly to Fortune 500 companies. Think office plants. Many companies today rent plants to decorate their premise. For a fixed sum, an external company would be responsible to supply and maintain a set of plants across the premise. The company is buying the fact that the premise is green and pleasing to be around. They are not buying plants and soil. There is no need for a chief plants officer. Sensors fall in the same category. What the company requires is data, not sensors. A supplier of sensors will, for a fee, install and service units throughout the premise to supply data that feeds into the information system to make decisions.

There will be a difference between what I refer to as captive sensors and free sensors. The data stream from captive sensors has only one predefined destination. For example, an environmental sensor in a company will send data only to that company. The data from a free sensor is available for anyone willing to pay for it.

Free sensors require a broker to setup the transaction since the sensor/data supplier will be too small in size to transact with the companies wanting the data. Think of the Google Ad words broker model. Any one with a web page can register with Google, the broker, to sell advertising to any company wanting to place an advertisement on that web page. Without Google playing the role of the broker there is no means for the web page owner to make a transaction with the advertiser to capture revenue from the content of their web page.

(This situation will change once Blockchain is deployed for web advertising but that is the subject of a different future blog. Same for sensor data. Blockchain will remove the need for a broker.)

The migration continues as the technology used to extract information from data also gets widely established. The same model applies. One more component is no longer required to be totally owned internally to access its outputs. Think of all the cloud analytics software available today. The data stream formats need to be defined, the type of analysis is selected and then out comes information that is then used to make decisions.

The real value resides in the decisions taken based on the information extracted from the data from the sensors. Until the sensors are widely available they need to be created internally. Until the data to information conversion is widely available then that function needs to be done internally. Once those two components are widely available then there is no need to divert internal resources to develop and maintain either.

The item that will not be externalised is the decision making since this is the essence of the business and this is the reason why the investment was approved in the first place.

I believe that the analytics part is in very good shape today since it is a very well understood, complex but and contained operation. The hard problem to solve is the availability of the sensor as a service scheme. There are millions of makers today that are ready to deploy all sorts of sophisticated sensors if they can find a way to capture revenue from that deployment. Today, there is no such possibility.

Why is that bad for everyone? well, because if no one can capture revenue from free sensors then the IoT market will remain on a healthy but controlled growth curve. Not all companies are able to deploy the end-to-end solution internally hence IoT will take much longer to reach all companies. Say maybe 10% to 20% annual growth rate which is healthy but not spectacular compared to what would happen if those millions of makers can capture revenue from their free sensors.

Here is a specific example, a smart and connected weather station that someone installed in Europe as a technology demonstrator project.

If there was a "sense" broker out there that they could sign up with then they could sell that data on a global scale. Someone in Japan studying the butterfly effect could use that data to refine their study of the global climate. A very simple transaction to do if we had Blockchain but we don't so we need a broker to handle that transaction instead. We need someone to play the Google of IoT sense nodes to make those transactions happen.

IoT platforms will not drive spectacular market growth unless they integrate revenue capture for free sensors. Otherwise IoT remains an extension to current IT infrastructure. A fantastic extension for sure but not the global revolution that we dream of.

Any one want to step up and play IoT "sense" broker?

The window of opportunity is till wide open since Blockchain for IoT is still far off in the future.

CEO, Balak Drishti. BOD/Investor/Cofounder-FleetNurse Inc, Edison Award Judge/Steering Committee Member, Advisor Nanusen, Entrepreneur. Leader/Exec. in Technology, Innovation and Strategy

7 å¹´You can sense, analyze, decide, but if you do not act, what is the point? Deciding to do something is not equal to acting. Actuation needs to be added. Lastly, after acting there is feedback loop to sense. So, this is an arrowed diagram not just block. All IMHO.

Founder and CEO at Prasaga

7 å¹´I have never used the phrase "sense broker" however I will start now. Our ecosystem does enable and we are.cureently preparing an ICO as we are integrating blockchain into the ecosystem for both payment for data consumed as well as device data Ident.

Technology Business Advisor | Market Entry & Growth Strategist | IoT, AI, Semiconductors, Digital Transformation

7 å¹´https://markets.businessinsider.com/news/stocks/IoT-Data-Exchanges-Services-Set-to-Transform-IoT-Landscape-1002274284

Technology Business Advisor | Market Entry & Growth Strategist | IoT, AI, Semiconductors, Digital Transformation

7 å¹´a broker https://www.businesswire.com/news/home/20170731005260/en/Samsung-Electronics-Launches-New-Data-Monetization-Solution

Founder @ Centre for Business Innovation Limited | Oxford Engineering Doctorate and INSEAD MBA | International Industry Consortium Leader

7 å¹´This is a really useful post, thank-you. It chimes with the thinking of the Open Innovation meets Big Data Consortium (Nissan, Lloyds Bank, LV, Telefonica etc) that there is an opportunity to trade data B2B in the spirit of open innovation in order to create net new value. We are thinking hard about the value add from different classes of data - and are tempted by McKinsey work which highlights the value of 'tactical decision making' which can be informed by buying in data 'on the fly'. They consortium has been working on applications like Smart Homes, Connected Cars, Open Banking and Future Retail and we are thinking of 'calving' areas like IoT/Blockchain into their own independent consortia. Get a feeling here https://www.cfbi.com/openinnovation.htm Details from me!