India’s digital payments landscape is transforming rapidly, becoming a global model for digital adoption. It is positioned for sustained growth, driven by tech innovation, infrastructure expansion, and supportive regulatory frameworks. This robust ecosystem is expected to unlock new revenue streams and expand financial inclusion, with key stakeholders poised to benefit.

Here’s a breakdown of key highlights and projections for the coming years:

- Overall Transaction Growth: Digital payments saw a 42% YoY transactional volume growth in FY 23–24 and is expected to triple from 159 Bn transactions in FY 23-24 to 481 Bn by FY 28-29. The transaction value is Expected to double from Rs. 265 Tr to Rs. 593 Tr in the same period.

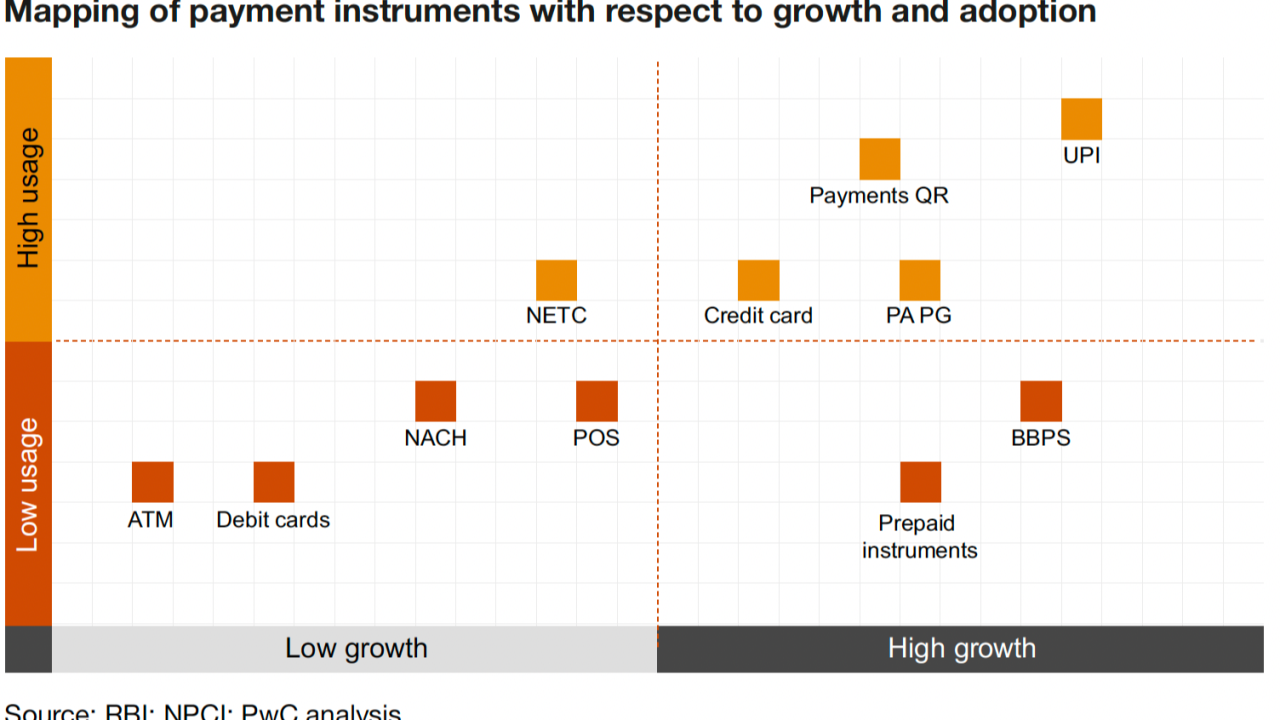

- UPI Dominance: UPI has grown by 57% YoY, with over 131 billion transactions in FY 23–24, projected to reach 439 billion by FY 28–29, constituting 91% of retail digital payments.

- Credit Cards: Over 16 million new credit cards were added in FY 23-24, taking the total to over 100 million. By FY 28-29, credit card usage is projected to reach 200 million.

- Bharat Bill Payments System (BBPS): Grew by 25%, supported by more billers and third-party app providers.

- NETC (Toll Collection): Over 10% growth, attributed to increased adoption of toll tags.

- Merchant Infrastructure: Increased adoption of digital payments by merchants, especially in tier 2, 3, and 4 cities. QR code adoption is up 30%, and the Payments Infrastructure Development Fund (PIDF) is furthering infrastructure growth.

- Emerging Tech & Ecosystem: Innovations, such as soundboxes for merchants and cross-sell strategies, enhance customer and merchant adoption.?

- FinTech Impact: Partnerships between FinTech firms and established issuers are driving growth in business payments, especially for cross-border transactions.

- Promotions & Regulations: Government initiatives and regulatory support boost customer awareness and innovation within digital payments.

- Consumer & Business Payments: Expanding use cases in both consumer and business payments, including a significant uptick in business payments through digital channels.

- Shifting Preferences: Debit card usage is declining, with consumers favoring credit cards and UPI options.

For more such interesting updated on the Fintech World, please follow my Substack Fintrest: https://fintrest.substack.com/publish/home