Chintai RWA Tokenization Platform Design Overview

Platform Goals

@ChintaiNetwork has the most comprehensive, licensed, compliant, convenient and cost-effective blockchain platform available today for issuing, trading and maintaining custody of Real World Assets (#RWA). The platform is designed to achieve two primary goals:

Platform Capabilities

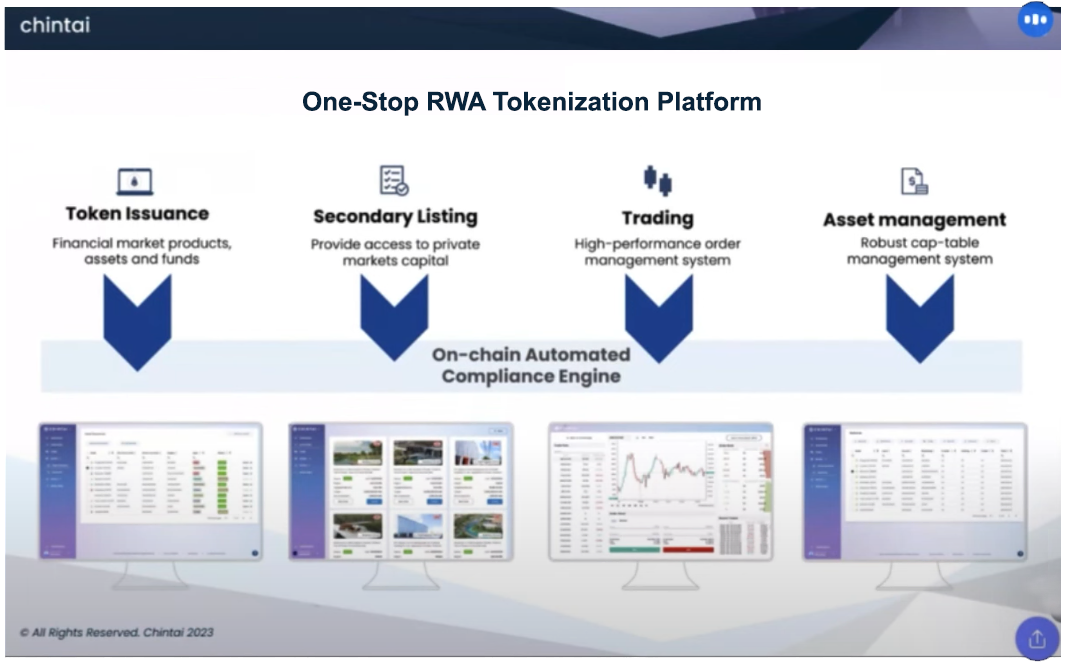

The platform fully integrates on-chain five essential capabilities:

Automated Compliance: Proprietary Sentinel automatic 24/7 transaction monitoring and reporting integrated into all issuance and secondary market functions, fully on-chain with automated compliance controls enforced in real-time, updated dynamically as regulators add or change rules in a given jurisdiction. Reduction of 50–70% in administrative overhead with automated transaction monitoring and reporting.

Walled Gardens in Singapore & British Virgin Islands

To maintain compliance with Singapore regulations, Chintai’s blockchain operates smart contracts running within two walled gardens: Chintai Singapore hosts regulated RWA issuance and trading, assets classified as securities; all other non-security assets are handled by Chintai Nexus, a subsidiary located in British Virgin Islands (BVI).

Chintai is licensed by the Monetary Authority of Singapore (MAS) to issue and trade securities. Accredited Chintai investors have access to RWA regulated by MAS using traditional fiat for liquidity. All other RWA not considered a security are handled in BVI using cryptocurrencies for liquidity.

Comprehensive Design

At its core, the platform is a one-stop regulated, licensed and fully compliant L1 blockchain for RWA tokenization, trading and custody. Any asset class can be tokenized and subsequently traded, including funds, bonds, real-estate, carbon credits and much more (think: Coinbase). Chintai’s also provides extensive white label services so business partners can dynamically issue and trade RWA using their own branded websites (think: Shopify).

The diagram below depicts the platform’s major components, user roles, accounts and activity flows.

Major Components

In blue, Chintai Singapore supports partner RWA issuance and accredited investor trading of security tokens; using Chintai white label services, partners also operate their own branded websites to issue and trade RWA.

In green, Chintai Nexus operates in British Virgin Islands and supports partner RWA issuance and retail investor trading of non-security tokens; using Chintai white label services, partners also operate their own branded websites to issue and trade RWA; liquidity providers can stake CHEX in liquidity and resource pools for yield.

In gray/red, Chintai Sentinel monitors all issuance and trading activity 7/24, applying automated regulatory compliance enforcement and reporting on-chain.

领英推荐

In gray/yellow, Chintai’s bridge (built on Fireblocks) supports RWA custody and cryptocurrency bridging between other blockchains and exchanges. Chintai also supports fiat ramps to banks for access to traditional liquidity.

In gray/black is the heart of the platform that supports all activity: Chintai’s private, permissioned L1 blockchain. The blockchain writes block hashes to the EOS public blockchain for audit trace purposes.

In white, Chintai’s bridge offers access to decentralized liquidity in several external, public blockchains.

Roles

In blue, partners issue regulated RWA security tokens with Chintai Signapore. Accredited, expert and institutional investors can trade and build their RWA portfolios with regulated RWA security tokens.

In green, partners issue RWA non-security tokens with Chintai Nexus (BVI). Retail investors can trade and build their RWA portfolios with RWA non-security tokens.

In purple, liquidity providers can stake CHEX in liquidity and resource pools for yield.

In yellow, traditional banks provide access to liquidity over Chintai’s fiat ramp.

In red, regulators in Singapore and BVI receive reporting information, including suspicious trading activity detected by Chintai Sentinal.

Account Types

Chintai supports varying levels of identity credentials; greater access is enabled as more credentials are provided. Accounts registered without providing KYC have limited access to functionality, restricted to providing liquidity in staking pools; accounts that perform KYC have increased access to more functionality, including trading of some non-security RWA; accounts that provide accredited, expert or institutional credentials have wide access, including trading RWA security tokens.

One Chain, Everything Entirely On-Chain

It is important to emphasize Chintai’s comprehensive RWA platform operates entirely on a single blockchain to ensure maximum security, performance, reliability and regulatory compliance. Moreover, the entire lifecycle of each RWA exists on-chain, from issuance and subsequent trading through maturity. Alternative platforms using partial-chain or multi-chain designs (often with L2 dependencies) are inherently flawed:

If the entire RWA lifecycle isn’t entirely on-chain there is no reason to use a blockchain in the first place.

Chintai Nexus

The Nexus website represents Chintai’s commitment to democratizing investor access to traditionally private, illiquid investments, expanding RWA access to retail investors more than ever before. Accredited, expert, institutional and retail investors can evaluate and trade RWA to diversify their investment portfolios. Liquidity providers can stake CHEX in liquidity and resource pools for yield.

Nexus also fulfills the longstanding need for a gateway between decentralized (DeFi) and traditional financial (TradFi) platforms, ramping fiat currencies and bridging liquidity between several blockchain protocols (BTC, ETH, SOL) and exchanges.

When Chintai Nexus opens for retail investors in January, 2024, the entire Chintai RWA platform will be fully engaged in its mission to transform traditional capital markets.

MBA, Engineer | Enterprise AI | Advanced Analytics | Third-Gen Cloud Data Platform with Governed and Secure Generative AI | World's First Arbor Essbase Post-Sales Consultant

9 个月Thank you for sharing Trenton!