The CFO's Guide to AI Ethics: Navigating the Black Box Problem in Financial Decision-Making

Salvatore Tirabassi

CFO Pro+Analytics | Top Fractional CFO Services | Growth Strategy | Modeling, Analytics, Transformation | 12 M&A & Exit Deals | $500M+ Capital Raised | 10 Yrs CFO | 15 Yrs VC & PE | Wharton MBA | New York & Remote

As a fractional CFO working across multiple organizations, I’ve observed a growing concern in the financial sector: the ethical implications of AI-driven decision-making. The “black box” nature of AI systems – where the input and output path isn’t clearly understood. This presents particular challenges in finance, where transparency and accountability are paramount. Here’s my perspective on navigating these complex waters and how AI makes financial decision-making more efficient and insightful.

Understanding the Role of the CFO

What is a Chief Financial Officer (CFO)?

A Chief Financial Officer (CFO) is the highest-ranking finance professional in an organization, responsible for the business's financial health. Traditionally, the role of the CFO was centered around accounting tasks such as managing financial records, ensuring compliance with financial regulations, and overseeing budgeting processes. However, the role has evolved significantly over the years. Today, a CFO is a key player in strategic decision-making, leveraging financial data to guide the organization’s direction and growth.

In this modern capacity, a CFO must deeply understand financial data and its implications for the business. They are tasked with forecasting future financial performance, identifying opportunities for cost savings, and advising on investment strategies. This requires strong analytical skills and the ability to communicate complex financial information to other executives and stakeholders. The CFO’s insights are crucial for making informed decisions that align with the organization’s long-term goals.

CFO Qualifications and Skills

To become a successful CFO, one typically needs 10-15 years of experience in finance, often starting in roles such as accounting or financial analysis. An advanced business degree, such as an MBA, is also highly beneficial. Knowledge of generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) is essential, as is a solid understanding of the organization’s industry and business strategy.

In addition to these foundational qualifications, a modern CFO must analyze massive amounts of data and use AI tools to support decision-making. This includes leveraging machine learning algorithms to identify trends and make predictions and using data-driven insights to inform strategic decisions. Strong leadership and management skills are also crucial, as the CFO must lead a team of finance professionals and collaborate with other departments to achieve the organization’s financial objectives.

The CFO’s Team

In large enterprises, the CFO is supported by a team of key personnel who handle various aspects of the organization’s financial operations. These include the Chief Accounting Officer (CAO), Controller, Treasurer, and Director of Financial Planning and Analysis (FP&A).?????

The CAO oversees tactical tasks, including SEC reporting, regulatory compliance, corporate governance, risk management, and ESG reporting. The Controller is responsible for the organization’s accounting and finance operations, creating financial reports, and leading a team of accountants, bookkeepers, and payroll specialists. The Treasurer manages the company’s liquidity, debt, and assets, ensuring the organization has the financial resources to operate effectively. The Director of FP&A plays a critical role in financial planning, producing forecasts, advising on market expansion, new business models, mergers and acquisitions (M&A), divestitures, and capital budgeting.

Together, this team supports the CFO in maintaining the organization's financial health and driving strategic decision-making.

The Evolution of the CFO Role

From Traditional Accounting Tasks to Strategic Decision-Making

The role of the CFO has undergone a significant transformation over the years. Traditionally, CFOs were primarily focused on accounting tasks such as managing financial records, ensuring compliance with financial regulations, and overseeing budgeting processes. While these responsibilities remain important, the modern CFO is expected to be a strategic leader who can drive business growth and innovation.

Today’s CFOs must analyze financial data, identify trends, and provide insights that inform strategic decisions. This involves not only understanding the numbers but also interpreting what they mean for the organization’s future. CFOs must also communicate complex financial information to non-financial stakeholders, including the CEO, board of directors, and investors, in a clear and actionable way.

With the increasing use of AI systems and machine learning, CFOs have powerful tools to support decision-making. These technologies can process massive amounts of data, identify patterns, and make predictions that would be impossible for humans to achieve independently. By leveraging AI tools, CFOs can gain deeper insights into the organization’s financial performance and make more informed decisions.

In this evolved role, the CFO is not just a financial expert but a key strategic advisor who helps shape the organization’s direction and ensures its long-term success.

Understanding the Black Box Problem

In my work with various organizations, I’ve seen how AI’s complexity can create a disconnect between decisions and their rationale. The decision-making process in finance requires transparency and accountability, which can be challenging when AI systems are involved. This “black box” problem occurs when:

The Stakes in Strategic Decision-Making

The implications of the black box problem are particularly significant in finance. Many AI-driven financial tools require a stable internet connection, enabling real-time data analysis and decision-making. As a fractional CFO, I’ve encountered these concerns across various financial functions:

Risk Assessment

Incorporating new data into risk assessment models can provide more accurate predictions and insights.

Regulatory Compliance

Appointing a new chief financial officer often brings fresh perspectives on regulatory compliance and financial strategies.

Real-World Impact

Let me share a recent example from my practice. A mid-sized financial services client implemented an AI-driven risk assessment system for loan approvals. While the system improved efficiency, we encountered several ethical challenges:

AI strategies must be organization-based, aligning with the overall business objectives and goals.

Key Ethical Considerations

Through my experience as a fractional CFO, I’ve identified several critical ethical considerations when implementing AI in finance:

Effective problem-solving is crucial in addressing the ethical challenges posed by AI in finance.

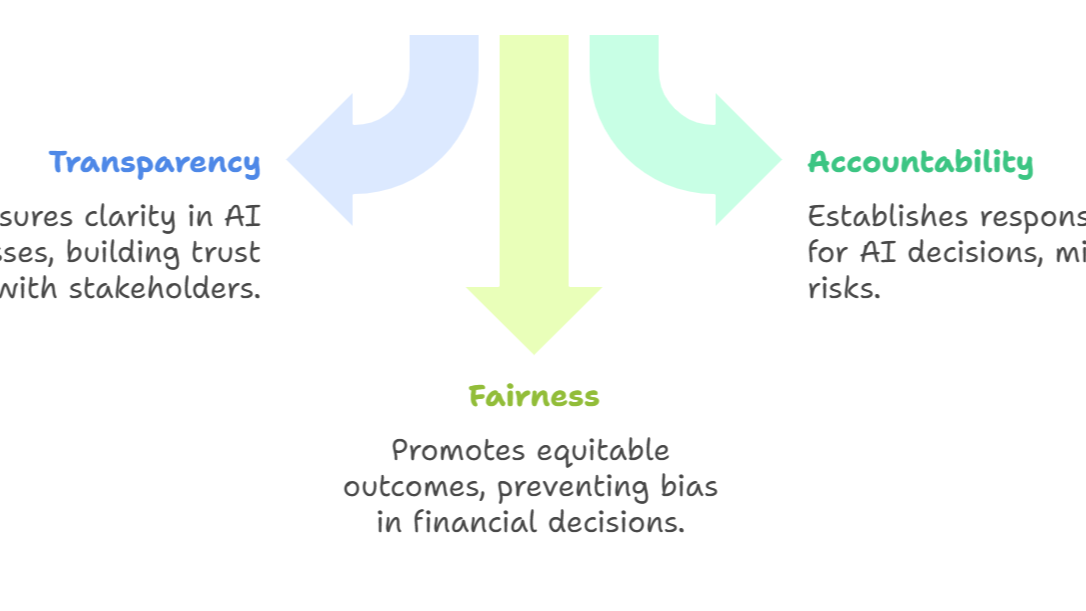

1. Transparency: Organizations must balance the power of AI with the need for transparent decision-making.

2. Accountability: Clear lines of responsibility must exist for AI-driven decisions.

3. Fairness: Systems must be regularly tested for bias and discriminatory patterns.

4. Privacy: Data usage must respect individual privacy rights and regulatory requirements.

Practical Solutions with AI Tools

Based on my experience implementing AI systems across various organizations, here are practical approaches to addressing these ethical challenges:

Research shows that implementing explainable AI and establishing governance frameworks can significantly mitigate ethical risks.

1. Implement Explainable AI

2. Establish Governance Framework

3. Ensure Data Quality

Risk Mitigation Strategies

As a financial leader, I've developed several strategies to mitigate the risks associated with AI's black box problem:

1. Hybrid Approach

2. Regular Testing and Validation

3. Stakeholder Communication

Building Trust in AI Systems

From my experience as a fractional CFO, building trust in AI systems requires:

1. Clear Documentation

- Document all system parameters

- Maintain detailed audit trails

- Record all system changes and updates

- Keep comprehensive training data records

2. Regular Review Process

- Schedule periodic system audits

- Review decision patterns

- Assess impact on various stakeholder groups

- Update protocols based on findings

3. Professional Development

- Train staff on ethical AI principles

- Develop an understanding of AI limitations

- Foster critical thinking about AI decisions

- Encourage questioning of unusual results

Industry-Specific Considerations?

Different sectors face unique challenges with AI ethics. In my work across industries, I've noted specific considerations for:

Financial Services

- Regulatory compliance requirements

- Fair lending obligations

- Consumer protection standards

- Risk management protocols

Healthcare Finance

- Patient data privacy

- Treatment cost predictions

- Insurance claim processing

- Resource allocation decisions

Manufacturing Finance

- Supply chain optimization

- Quality control decisions

- Cost forecasting

- Investment prioritization?

Future Considerations

As AI technology evolves, organizations must stay ahead of ethical considerations:

Emerging Challenges

- Increasing algorithm complexity

- Growing regulatory scrutiny

- Rising stakeholder expectations

- Evolving privacy standards

Preparation Strategies

- Regular policy reviews

- Ongoing staff training

- Technology assessment protocols

- Stakeholder engagement plans

Frequently Asked Questions

Q: How can we ensure AI decisions in finance remain auditable and compliant?

A: As a fractional CFO, I recommend implementing a three-tier system: detailed documentation of all AI decisions, regular third-party audits of the system, and maintaining human oversight for critical decisions. Additionally, ensure your AI system can generate detailed logs and explanations for each significant financial decision.?

Q: What are the key warning signs that an AI system's decisions might be biased?

A: Look for patterns in decisions that correlate with protected characteristics, unexplainable variations in outcomes for similar cases, and consistent disparities in approval/rejection rates among different groups. In my experience across multiple organizations, regular statistical analysis of decisions and outcomes is crucial for detecting potential bias.

Q: How often should we review and update our AI ethics policies?

A: Based on my experience managing AI implementations, I recommend quarterly reviews of AI ethics policies, with immediate reviews triggered by any significant changes in regulations, technology, or observed issues. Annual third-party ethics audits can also provide valuable external perspectives.

This article was originally published on cfoproanalytics.com titled The CFO’s Guide to AI Ethics: Navigating the Black Box Problem in Financial Decision-Making

..

For more information or to schedule a meeting, contact: