A core part of Atomic's thesis is that capital alone doesn't solve all problems. The most well-funded companies don't?necessarily deliver the best results. In fact, too much money too soon can create problems as it forces scale when the basics may not yet be in place.

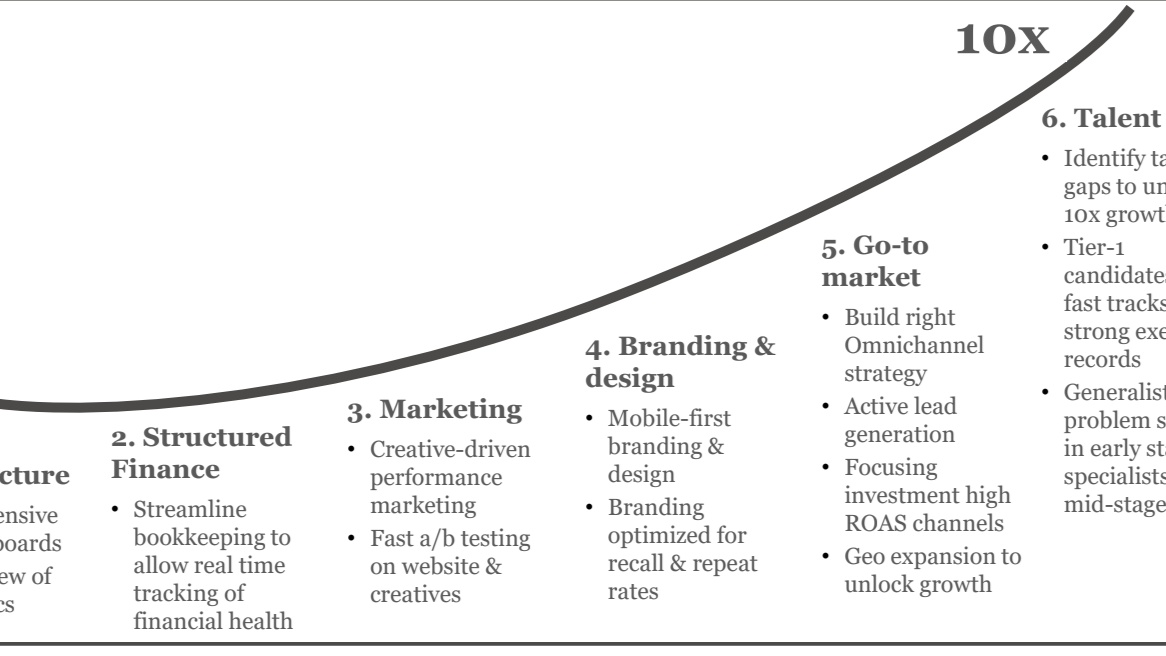

As an investor we like to partner with founders beyond capital. Every company's journey is unique and there is?no one-size-fits-all?method to company building. However, there are few areas that are common in the value creation journey.

- Data infrastructure: Companies and founders need to have irrational belief during the 0-1 journey and often requires?a bit of a leap of faith. However, 1-100 needs to be complimented with data-driven rational decision making. We work very closely with founders to identify frequency as well as the right KPIs to look at, because what gets measured gets managed. We also use data to not just manage performance but also define conditions for experimentation. e.g. when launching a new SKU, you need to set a timeline and target volume to have sold by then coupled with marketing budgets to decide if you want to invest in scaling it further or kill it.

- Structured finance: Often founders rely solely on equity which is the most expensive form of capital. However, few use cases e.g. inventory, are better managed via revenue-based financing, term loan, venture debt, etc. In a fast growing company, cash is oxygen. Usually given focus on growth, founders can end up being overly focussed on topline metrics alone. We work with teams to define optimal capital requirements of the business and maintain a strong view of cash.?

- Marketing:?Given our focus on consumer businesses, marketing is one of the most critical enablers in a company's journey. We work with companies across various marketing areas such as?creatives, conversion optimization, retention, etc.?to combine founder intuition about the market with demand side signals.

- Branding: For a brand, the brand story and the reason it exists. This is especially important in the wave of premiumization?that we are seeing across categories, where the bar on aesthetics is high. Design aesthetics?need to be decided in the context of a target audience. We've seen that there is no templatized approach that works. We've had experience working?with founders to optimize digital assets, websites, etc.?

- Go-to-market: Omni-channel is the new IT thing. What you are never told is that different channels are important at different scales e.g. as an 1Cr annual revenue brand if you are present across 200+ outlets and 5-6 different online marketplaces, you are spreading yourself too thin. It is important to make a channel?work in terms of capital and operational efficiency before you pour more money to scale it e.g. for upto INR 80-100Cr ARR (annualized run rate) scale we rely mainly on online channels vs adding offline channels to the mix starts to play a critical role at INR 100CR+ ARR.?We like to keep category nuances and market nuances for defining GTM plans for companies which change over time. Brands need to?keep abreast with consumer preferences,?e.g. with q-commerce customer preferences are fast changing

- Talent: We believe ideas are cheap, but what really matters is execution. For driving robust execution, talent becomes an enabler. We work with founders to source, evaluate, and onboard the right talent for the company's context. Different companies have different strengths and critical functions e.g. for a business involving procurement from multiple fragmented suppliers a strong Ops/finance leader is important vs for backward integrated org marketing maybe prioritized to unlock scale.?

We don't necessarily have technical expertise in each and every area. So we rely on our network of experts to help e.g. we work with recruiters to?generate a strong funnel of candidates. A company's journey is very rarely linear, no one has a crystal ball about what exact?thing will?work for a company vs not. We work with founders to tailor the value creation.?

In next few weeks, we will further deep dive into these pillars of value creation.??

Chief Operating Officer

2 天前Well articulated Apoorv Gautam After spending almost 2 decades launching & establishing brands in multiple categories & now building Flyberry Gourmet I believe these 2 things are most important for any business: 1. Getting the basic right : as this is the building blocks/ foundation for any business to flourish 2. Execution: Consistently executing the basics . Both these seem simple but are easier said than done ??

Building Purposeful Brands | Founder and CEO at Mamamor | Founder at Bombay Drawing Room | Angel Investor

1 周Great to see a venture fund that truly values ‘beyond the cheque’ support, Apoorv. As a founder, it completely resonates —where both sides invest deeply, not just financially but strategically. For someone in the thick of building, this approach is incredibly impactful. Excited to see the kind of journeys Atomic helps shape!

Finance Business Leader | Growth Strategy and Pivot | Consumer First | Enable Tech | Cash and P&L Ownership | Management Deck | Accounting | Supply Chain | Compliances | Start-up | Investor Relationship | Soonicorn |

2 周Shubham Kumar Navin K.

Co-founder @ Stealth Mode | IIT Delhi 2019 (Dogra Award) | Ex-Schlumberger | Marketing Geek

2 周Good insights. Execution should be focused on these key pillars.

Director Attica Interio, a Sustainable Home Textile Company/ Board Member- Capital Goods Ventures,

2 周Very apt understanding on the systemic building up the venture especially the GTM. Grounded on strategy leading to robust execution. But all are focused on D2C. Would like to see some knowledge sharing on B2B venture.