Bad Debts Meaning and Accounting Flow

Bad Debts Accounting Flow

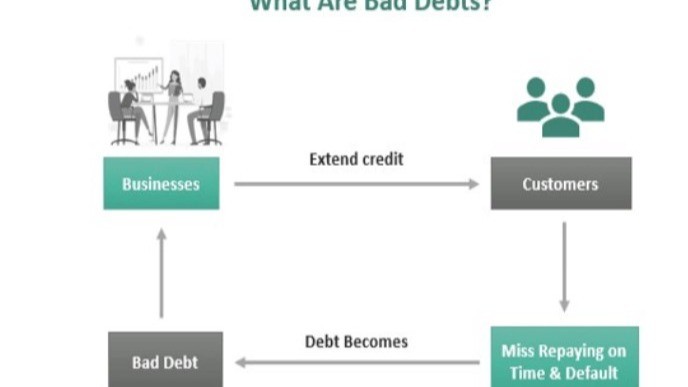

When customer unable to pay outstanding against goods or services received then we make to provision of Bad debts

Technically bad debt is clarified as an expense. It is reported along with other selling, general, and administrative costs. In either case, bad debt represents a reduction in net income

Methods of Estimating Bad Debt: This is depending on which method organization wants to be adopted. It varies upon organization considering trend of bad debts. Majorly there are below methods:

1.??? Aging Method: here aging groups are defined by company like 30-60 days company will make a provision of bad debts 1%, 60-180 days – 2% and above 180 to 365 -5% and above 365 days making 100% provisions in books.

2.??? Percentage of sale method: A bad debt expense can be estimated by taking a percentage of net sales based on the company’s historical experience with bad debt.

Why is Tracking Bad Debt Expense Important?

1.??? Accurate Financial Reporting

2.??? Cash Flow and Liquidity Management

3.??? Risk Management and Process Optimization

?4.??? Budgeting and Forecasting

?5.??? Balancing the Books and Tax Benefits: Bad debt is recorded as an expense in your general ledger and appears as an operational cost on your income statement. This means you won’t pay taxes on income you never earned, providing some relief in your tax obligations. Tracking bad debt helps you balance your books and ensures that your financial reporting remains compliant.

Accounting Flow for Bad Debts:

?

1.??? Direct Write-Off Method: The bad debt is directly written off against accounts receivable when it is deemed uncollectible.

?

Bad Debts Expense??????????? XXX (Charged off to P&L)

??????????????????????? ??????????? Accounts Receivable????????? XXX (B/s impact to Current Assets)

?

领英推荐

2.??? Allowance Method: An estimate of bad debts is made at the end of each accounting period, and an allowance for doubtful accounts is created.

?

Bad Debts Expense??????????? XXX

??????????? Allowance for doubtful debts???????????????? XXX (Contra Asset Ledger)

?

?

When Write-off:

?

Allowance for doubtful debts???????????????? XXX

??????????????????????? Accounts Receivables??????????????????? XXX? (Customer Ledger)

?

?

When customer pay back later on. This was earlier declared as Bad Debts and written off in books.

?

1.??? Accounts Receivables????????????? XXX? (Customer Ledger)

??????????????????????? ??????????? Allowance for doubtful debts???????????????? XXX

?

2.??? Cash A/c????????????? XXX

??????????? ??????????? Accounts Receivables??????????????????? XXX? (Customer Ledger)

Stay tuned for more updates. Pls do like , comment and Share !!

Thanks in Advance :)

?