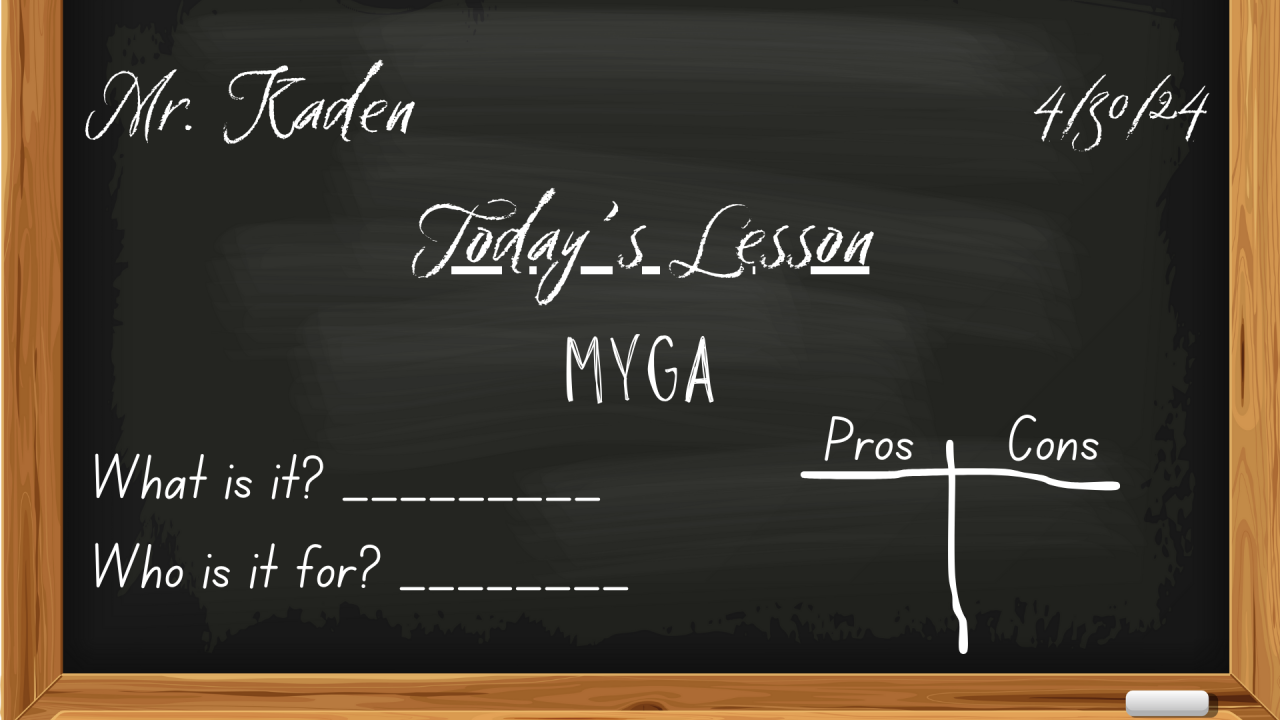

All About MYGAS What are they, who are they for?

Hello,

Ever heard of a MYGA?

Most people haven’t, and that’s okay. They’re not for everyone, in fact, they’re really only for one type: ULTRA CONSERVATIVE.

If that’s not you, I completely get it. It’s not me either. But it doesn’t hurt to learn something new!

So what is it?

MYGA stands for Multi-Year Guarantee Annuity, which is like a fixed-rate annuity.

Think of it as the annuity version of a CD.

They both work similarly: you get a set interest rate each year for a certain number of years that you pick.

The benefits are:

*Rates in May for one of the Top Issuers will be:

3 Year Period: 5.3%

5 Year Period: 5.5%

If one can handle a longer maturation date, they can probably move up to an Indexed Annuity product that offers higher potential returns over 7 or 10 years.

Remember, MYGAs are for the ultra-conservative, folks looking for minimal commitment and a guaranteed fixed rate of return during that time.

Deposits are usually a lump sum, originating from an after-tax cash account like checking or savings.

领英推荐

People who participate in MYGAs can take their money and run after the maturation date for whatever reason or decide to re-up and re-enlist their funds at whatever the rates are at that time.

This isn’t a bad idea for someone - Looking for certainty - Without many years left to compound (they need the guarantee) - May have the idea of using their money for another opportunity after 3 years

They are not for - Aggressive investors - People requiring for double-digit returns - Someone with 7 or more years to go till retirement

Anyone unsure can always go through a consultation with a licensed professional who can help make recommendations based on financial goals.

For comparison: - Bonds change interest rates every 6 months (they can go up, they can go down) - Current 3 Year Government Bond Yield is 4.806% (50 basis points < MYGA)

In my opinion, someone who is going the bond route anyway and is okay with a 3-year or 5-year term might be wise to consider the MYGA as an alternative because of its similarity, and slight edge.

Rates listed are for example. They are based on rates of 4/29/24 and are subject to change depending on when the reader is accessing this article.

Short and sweet this week!

You know what to do if you have any q’s.

Be well,

Chris Kaden

Owner?I?Retirement Income Optimizer?I?Kaden Prosperity Protectors?I?Powered by?FINLine Financial

Proudly serving families in TX, FL, OH, GA, IN, IL, LA, WV, VA, NE, MO, NC Direct Contact: 713-819-4218

Schedule an appointment?www.calendly.com/ckaden

Donations for content creation are appreciated :)?buymeacoffee.com/chriskaden